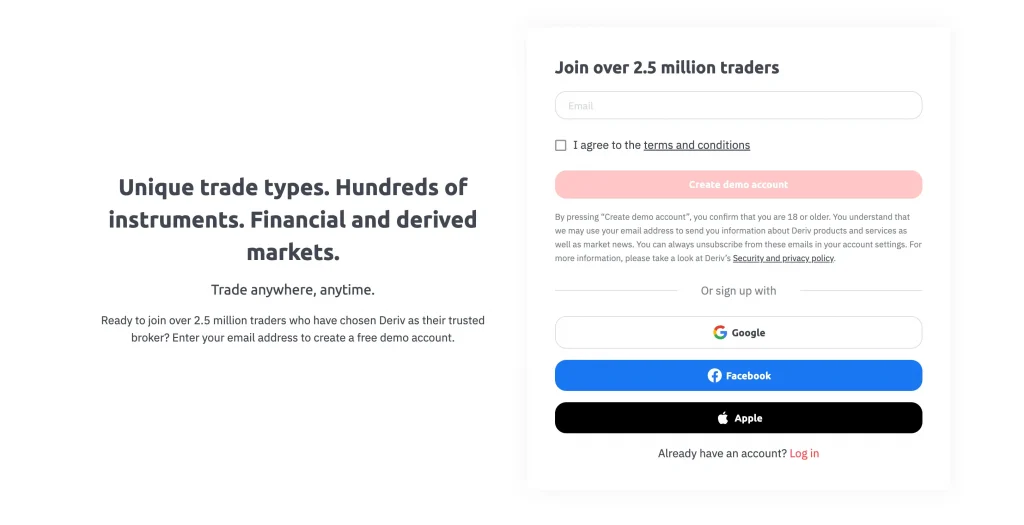

Deriv Registration

To start trading activities with Deriv, you need to go through a simple registration process. We have prepared step-by-step instructions for opening a real account on the official website deriv.com. The company guarantees compliance with all rules of financial regulators in different countries, as well as maximum security and protection of personal data of each client.

The Procedure for Opening a Real Trading Account

- Go to the deriv.com website.

- In the top right corner, select the “Register” or “Open Real Account” option.

- Fill out the form, providing personal information, contact details, and creating a secure password.

- Confirm the registration by clicking the link in the email sent to the specified email address.

- Choose one of the available account types (Deriv CFD, Deriv Multipliers, etc.) and the currency.

- After confirming the information from the application, your account will be successfully opened.

- Now you can deposit funds and continue with verification to activate trading.

Real Account Types in Deriv

Deriv offers the following real account opening options:

Account Type | Description |

Deriv CFD | For trading Contracts for Difference (CFDs) on currency pairs, stocks, stock indices, cryptocurrencies, commodities, ETFs |

Deriv Multipliers | For trading Multiplier Options with a fixed expiration date on currencies, cryptocurrencies, indices, commodities |

Deriv STP | Standard account for CFD trading on Forex, indices, and cryptocurrencies through ECN execution |

Swap-Free | Interest-free trading account for Islamic traders, without swaps and rollover fees |

You need to choose the account type based on your preferences and experience in trading. It is possible to create multiple accounts of different types.

Account Verification

Document | Identity |

Valid national passport | ✓ |

National ID card | ✓ |

Temporary ID | ✓ |

Military ID | ✓ |

Driver’s license | ✓ |

After opening a real account with Deriv, you will need to verify your identity and residential address to ensure security:

- Go to the personal account and open the “Profile Settings” section.

- Upload document pages (passport, ID, or driver’s license) for identity verification.

- Upload documents confirming your address (receipts, statements, rental agreements, etc.).

- Wait for approval from the Deriv security service, usually within 1-2 business days.

After successful verification, all trading account functions, including financial operations, will become available.

Additional Account Features

After verifying your account, you will be able to:

- Place various order types (market, limit, stop, etc.)

- Use trading robots, advisors, and signals

- Withdraw funds from the account to bank cards, e-wallets, crypto wallets

- Attract investors and manage capital in the PAMM service

- Connect copying of trades from successful traders

- Receive SMS alerts about important account events

Deriv provides clients with the maximum number of trading instruments and services for effective work in the financial markets.

Emerging Issues

Client reviews mention questions regarding account opening verification.

The solution in this situation is to go through the procedure step by step for each new device:

- In case of a verification error for the selected account type, you need to go through the registration process again.

- If there are problems when uploading documents to confirm identity or address, you should contact support to resolve the issue.

- Questions about setting up secure login methods to the personal account should also be resolved through support specialists.

- Errors in choosing the account currency require resetting the profile settings and re-registration.

In general, Deriv strives to maximize the simplicity of the account opening and verification process, but sometimes there are rare cases of problems that the company is constantly working to fix.

If you have any questions or need assistance, feel free to contact the multilingual support service specialists. We will also be glad to hear your feedback and suggestions for improving our products and services.

FAQ

Yes, you are allowed to create additional real accounts (CFD, Multipliers, etc.) to separate funds by asset classes or trading strategies. But you will need to go through the verification procedure for each new account.

It is enough to provide one document that identifies your identity (passport, driver’s license, ID) and one that confirms your place of residence (bank statement, rental agreement, utility bills).

A Multiplier Option is a type of binary/fixed option with a pre-known potential profit or loss, which closes automatically after a certain time.